How to Evaluate Insurance Options for Your Details Requirements

Exploring Various Kinds of Insurance Coverage: A Comprehensive Guide

Health Insurance

In today's significantly complex medical care landscape, medical insurance acts as an essential safeguard for individuals and families, ensuring access to essential medical solutions - insurance. It offers economic protection versus high medical expenses, making it possible for insurance policy holders to obtain timely and appropriate care without incurring debilitating expenditures

Wellness insurance policy plans commonly fall under numerous categories, including employer-sponsored strategies, government programs like Medicare and Medicaid, and individual strategies bought with markets. Each kind offers different protection degrees, costs, and out-of-pocket expenses. Trick parts of a lot of medical insurance policies consist of copayments, deductibles, and coinsurance, which determine just how costs are shared between the insurance company and the guaranteed.

Picking the right medical insurance plan requires careful consideration of individual wellness requirements, budget restraints, and service provider networks. insurance. It is necessary to analyze advantages like preventative treatment, a hospital stay, prescription medicines, and specialist solutions. Comprehending the strategy's conditions and terms can help stay clear of unforeseen costs.

Car Insurance Coverage

While navigating the roads can bring unforeseen obstacles, auto insurance coverage is essential for protecting drivers and their vehicles from economic losses arising from mishaps, theft, or damage. It works as a vital financial safeguard, making sure that the expenses related to repair work, medical expenditures, and responsibility cases are covered.

Auto insurance policy usually consists of numerous sorts of coverage. Liability insurance coverage is compulsory in many states, protecting versus insurance claims made by others for bodily injury or residential property damages. Collision coverage pays for problems to your car arising from an accident with another lorry or item, while comprehensive insurance coverage addresses non-collision-related events such as burglary, vandalism, or all-natural catastrophes.

Chauffeurs can additionally think about added choices such as uninsured/underinsured vehicle driver protection, which safeguards versus chauffeurs lacking adequate insurance coverage. Premiums are affected by various aspects, consisting of driving background, automobile type, and area.

Life Insurance Policy

Automobile insurance policy protects vehicle drivers when traveling, but life insurance policy offers a various type of safety and security by safeguarding the monetary future of loved ones in case of the insurance holder's fatality. Life insurance policy policies generally fall under two primary classifications: term life insurance policy and entire life insurance.

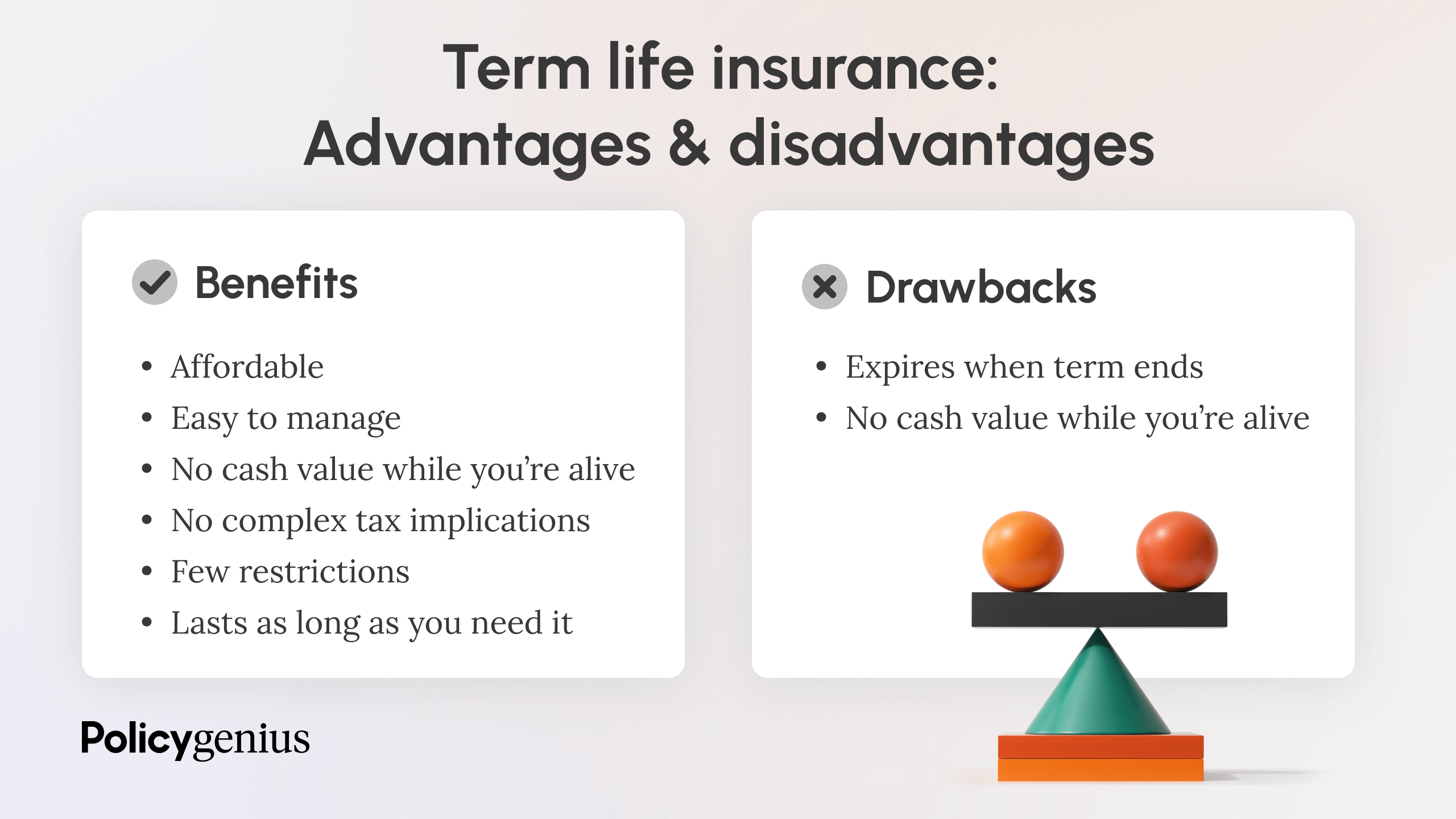

Term life insurance offers insurance coverage for a specified term, normally ranging from 10 to 30 years. If the insured passes away throughout this period, recipients receive a death benefit. This type of policy is often much more inexpensive, making it an appealing alternative for those seeking momentary coverage.

On the other hand, entire life insurance uses long-lasting defense and includes a money worth part that accumulates gradually - insurance. This cash money worth can be borrowed against or taken out, giving policyholders with additional monetary adaptability. Whole life insurance policy costs are usually greater than those of term policies, reflecting the lifelong protection and savings element

Eventually, selecting the appropriate life insurance policy relies on individual circumstances, monetary objectives, and the details needs of beneficiaries. By comprehending the differences in between these policies, individuals can make educated choices to guarantee their loved ones are economically safe and secure.

Building Insurance Policy

Property insurance policy is important for shielding your substantial properties, such as homes, business structures, and personal possessions. This kind of insurance provides financial protection against risks such as fire, theft, vandalism, and all-natural calamities, making index sure that insurance policy holders can recuperate their losses and rebuild after unfavorable events.

There are a number of types of residential property insurance readily available, including house owners insurance, tenants insurance, and industrial property insurance coverage. Occupants insurance safeguards occupants' individual items and uses responsibility coverage, though it does not cover the physical framework itself.

When picking home insurance, it is critical to evaluate the worth of your properties and the specific dangers connected with your location. Insurance policy holders must meticulously examine coverage exemptions, deductibles, and limits to guarantee appropriate defense. In addition, understanding the claims process and preserving an updated stock of insured things can promote a smoother recuperation in case of a loss. Overall, home insurance coverage plays an essential duty in economic protection and assurance for businesses and individuals alike.

Specialized Insurance Policy

Specialized insurance caters to one-of-a-kind threats and needs that are not generally covered by standard insurance plan. This kind of insurance coverage is designed for people and companies that require coverage for particular, frequently uncommon scenarios. Examples consist of insurance coverage for high-value antiques, such as art and antiques, along with plans for specific niche industries such as marine, air travel, and cyber obligation.

One of the key benefits of specialty insurance coverage is its ability to give personalized solutions tailored to the insured's certain demands. Event coordinators may seek specialized protection to secure against prospective obligations linked with large events, while companies in the technology industry may look for cyber obligation insurance coverage to guard versus information violations.

Additionally, specialty insurance coverage often includes protection for emerging dangers, such as those relevant to environment adjustment or progressing innovations. As the landscape of threat proceeds to transform, services and people are significantly identifying the importance of securing specialized coverage redirected here to reduce prospective monetary losses. Spending and recognizing in specialty insurance policy can be a critical decision that not only safeguards distinct possessions however also enhances overall risk management strategies.

Conclusion

From health and vehicle insurance coverage to life and residential or commercial property coverage, each classification presents distinctive advantages tailored to details needs.Vehicle insurance coverage generally consists of a number of kinds of protection. Whole life insurance coverage premiums are normally higher than those of term plans, reflecting the long-lasting coverage and cost savings aspect.

There are a number of kinds of residential property insurance offered, including house owners insurance, tenants insurance policy, and commercial residential property insurance.Specialty insurance coverage provides to unique dangers and requires that are not generally covered by common insurance policies.